Imagine a store selling apples. Some might look shiny and perfect, but could be rotten inside. Fundamental analysis is like checking the inside – looking at a company’s financials and other factors to see if its stock price reflects its true value.

Real-life Example of investing with fundamental analysis

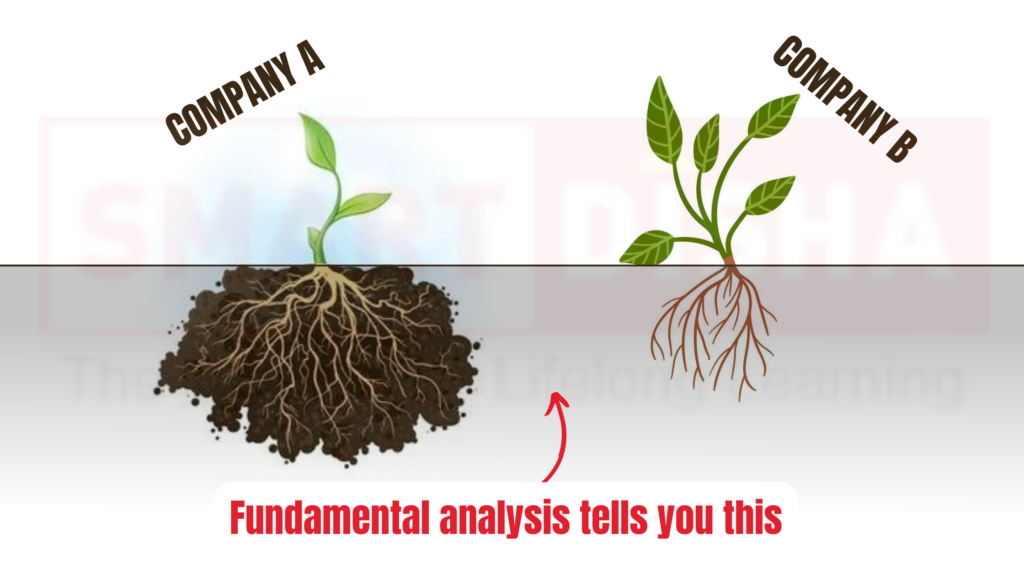

Company A and B might both be in the clothing industry. Company A might have a great brand and loyal customers, while Company B might be struggling. Even if their stock prices are similar, fundamental analysis would help you understand which company is truly “worth” more.

Q: Isn’t the stock market already efficient? Why do analysis?

A: The Efficient Market Hypothesis (EMH) says prices reflect all available information. But some believe markets aren’t always perfectly efficient. Fundamental analysis can help you find stocks that might be undervalued (trading lower than their true worth).

Q: What kind of information do fundamental analysts use?

A: They look at a company’s financial statements (like income and balance sheet), industry trends, and even the overall economy.

Q: Does focusing on price charts do the same thing?

A: Technical analysis can be helpful, but fundamental analysis looks at the company’s “health” to understand its long-term prospects, not just short-term price movements.

Best point in the fundamental analysis

- Company’s Financial Performance: Look at profits, debts, and how efficiently they manage money.

- Industry Trends: Is the industry growing or shrinking? How will this affect the company?

- Future Outlook: Does the company have a strong plan for growth and innovation?

Mistake as beginner you need to check

- Information Overload: There’s a lot of data to analyze! Start with a few key metrics like earnings per share (EPS) and gradually learn more.

- Emotional Investing: Don’t let hunches or excitement cloud your judgement. Stick to your analysis and invest for the long term.

Conclusion:

The Efficient Market Hypothesis suggests that beating the market might be difficult. However, fundamental analysis can give you an edge by helping you identify companies with strong potential that might be undervalued. By understanding a company’s true worth, you can make informed investment decisions and potentially achieve better returns over time.

Remember if you are Beginner

- Fundamental analysis is a marathon, not a sprint. Be patient and focus on the long term.

- Do your own research and never invest based solely on someone else’s advice.

Efficient Market Hypothesis vs. Fundamental Analysis

Here’s a table comparing the Efficient Market Hypothesis (EMH) and Fundamental Analysis:

| Feature | Efficient Market Hypothesis (EMH) | Fundamental Analysis |

| Market Prices | Reflect all available information | May be inefficient and contain mispricing |

| Investment Strategy | Passive investing (track broad market) | Active investing (research individual stocks) |

| Analyst Role | Limited – information is already priced in | Crucial – identify undervalued/overvalued companies |

| Technical Analysis | Irrelevant – past data doesn’t predict future | May be useful to identify short-term trends |

| Market Efficiency | Market is always efficient | Market can be inefficient in the short term |

| Alpha Generation | Not possible consistently | Possible through in-depth research and analysis |

Key Differences between EMH and Fundamental Analysis

- Market Efficiency: EMH assumes markets are completely efficient, while Fundamental Analysis believes inefficiencies can exist.

- Investment Approach: EMH promotes passive investing, while Fundamental Analysis encourages active stock picking.

- Information Usage: EMH considers all information is already priced in, while Fundamental Analysis focuses on identifying undervalued companies through research.

Remember: EMH is a theoretical framework, and its validity is debated. Fundamental Analysis is a practical approach used by many investors.

3 Flavor’s of EMH information

The Efficient Market Hypothesis (EMH) comes in three flavor’s, reflecting different levels of information access:

- Weak Form EMH: This version says current prices reflect all past publicly available information. So, studying historical price charts (technical analysis) won’t give you an edge.

- Semi-Strong Form EMH: This builds on the weak form, adding that current prices reflect all publicly available information, including financial news and company reports. So, fundamental analysis alone might not be enough to consistently beat the market.

- Strong Form EMH: This is the strictest form, assuming prices reflect all information, including insider information not available to the public. In this ideal, no one can consistently outperform the market.

Think of it like circles: Weak EMH is the smallest circle (least information), with strong EMH being the largest (all information).