To long? don’t read summary is here:

- GDP shows the health of the economy — higher GDP usually boosts investor confidence

- Unemployment reflects job availability — lower unemployment is good for business growth

- Inflation affects purchasing power — high inflation can reduce profits and raise market volatility

- Smart investors track these indicators to guide decisions and reduce risk

You don’t need to be an economist to make smart investment decisions, but understanding a few key numbers can go a long way. Economic indicators like GDP, inflation, and unemployment help paint a clear picture of how the country is performing — and where the markets may be headed

As an investor in India, knowing how these indicators affect different sectors can help you reduce risks and spot opportunities

GDP (Gross Domestic Product): India’s Economic Scorecard

What is GDP?

GDP measures the total value of goods and services produced in the country. It’s the most commonly used measure of economic performance

Why it matters:

- Rising GDP = Economic growth = Higher corporate profits = Better stock performance.

- Falling GDP = Economic slowdown = Lower earnings = Riskier markets

Example:

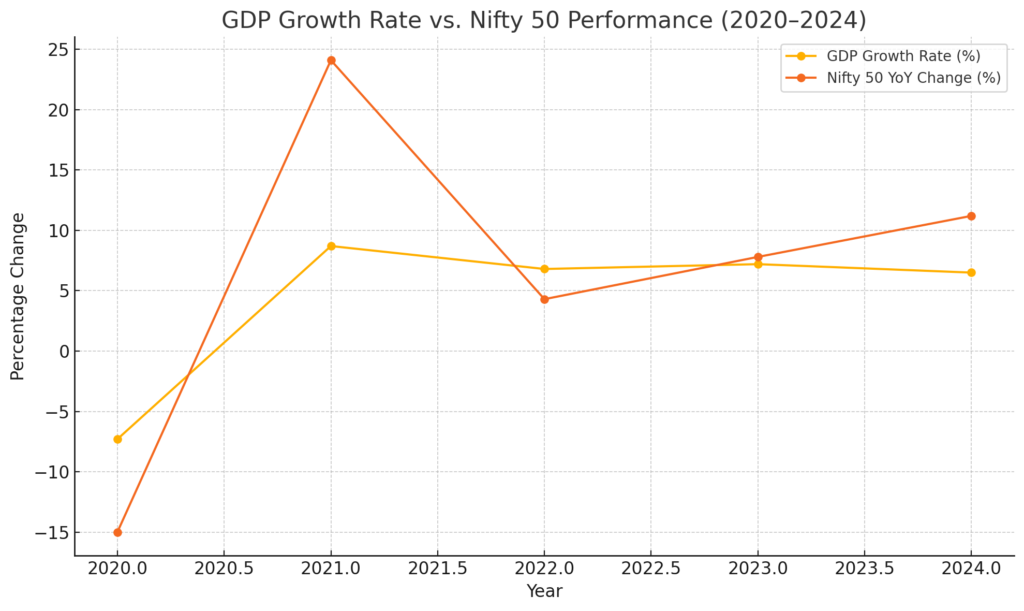

India’s GDP shrank sharply during the 2020 COVID-19 lockdowns, and markets followed. As recovery picked up in 2021, the Sensex and Nifty surged, driven by improved investor confidence

Unemployment Rate: A Pulse on Job Market Health

What is unemployment rate?

It shows the percentage of people actively looking for jobs but not getting them

Why it matters:

- High unemployment = Low consumer spending = Lower demand = Business slowdown

- Low unemployment = Strong demand = Economic growth

Example:

India’s unemployment spiked to 23.5% in April 2020. This hit sectors like retail and travel hard. As jobs recovered, stocks in these sectors bounced back too

Inflation: The Silent Wallet Killer

What is inflation?

It’s the rate at which prices for goods and services rise over time

Why it matters:

- High inflation = Reduced purchasing power = Lower profits = Stock market uncertainty

- Moderate inflation = Healthy economic activity

Example:

In 2021, India saw sharp inflation due to fuel price hikes and global disruptions. Consumer goods companies struggled with thin profit margins, which reflected in their stock performance

How to Use Economic Indicators in Your Investment Strategy

- Track Monthly Reports

Follow RBI updates, CMIE data, and economic news regularly. Awareness = readiness - Diversify Smartly

Balance your portfolio across sectors and asset classes — mix growth and defensive plays - Think Sectorally

- During GDP growth: focus on financials, tech, and consumer discretionary

- During high unemployment: consider utilities, FMCG, and healthcare

- During inflation: gold, pharma, and inflation-linked bonds are safer

- Look Beyond Numbers

Economic indicators are part of a larger story. Always consider government policies, global cues, and investor sentiment

Conclusion

Economic indicators like GDP, inflation, and unemployment are more than just numbers — they shape market direction. As an Indian investor, using them as tools rather than noise can help you stay one step ahead, especially in a volatile market

By tracking these indicators regularly, diversifying your investments, and adjusting based on current trends, you can build a more resilient and informed investment strategy

FAQs

What is GDP and why should investors care?

GDP reflects economic growth. A growing GDP usually means more business activity, which can boost stock prices

How does inflation affect investments?

High inflation reduces purchasing power and corporate profits, leading to stock market volatility

What can I invest in during economic uncertainty?

Defensive sectors like utilities, pharma, and consumer staples typically hold up better during downturns