When it comes to stock market investing, few sectors are as vital to the economy as Banking and Finance stocks. These institutions are not just ordinary companies listed on the exchange — they form the backbone of credit, liquidity, and the overall flow of money across the economy. Because of their central role, Banking and Finance stocks often behave differently compared to sectors like consumer goods or technology. Two of the most powerful factors that drive their valuation are interest rates and regulatory policies. Understanding how these forces shape stock performance is essential for any investor aiming to make informed decisions in this sector

Why Interest Rates Matter So Much

Banks make money primarily through the difference between what they pay depositors and what they charge borrowers this spread is called Net Interest Margin (NIM). When interest rates change, this spread can expand or contract, directly affecting profitability

Rising interest rates: At first glance, higher rates seem like good news for banks. They can charge more for loans while deposit rates adjust more slowly, often widening NIM. For example, if the RBI hikes rates, a bank may increase home loan rates from 8% to 9%, while keeping savings account rates at 3.5%. That extra margin translates into higher income

- But there’s a catch: Higher borrowing costs can also slow down loan demand. Individuals may delay taking home loans, and businesses may pause expansion plans. As a result, while margins improve, the overall volume of lending could drop

- Falling interest rates: On the flip side, when rates fall, banks attract more borrowers. Housing, auto, and corporate loans surge, boosting loan books. But margins shrink, since deposit rates don’t fall as fast as lending rates

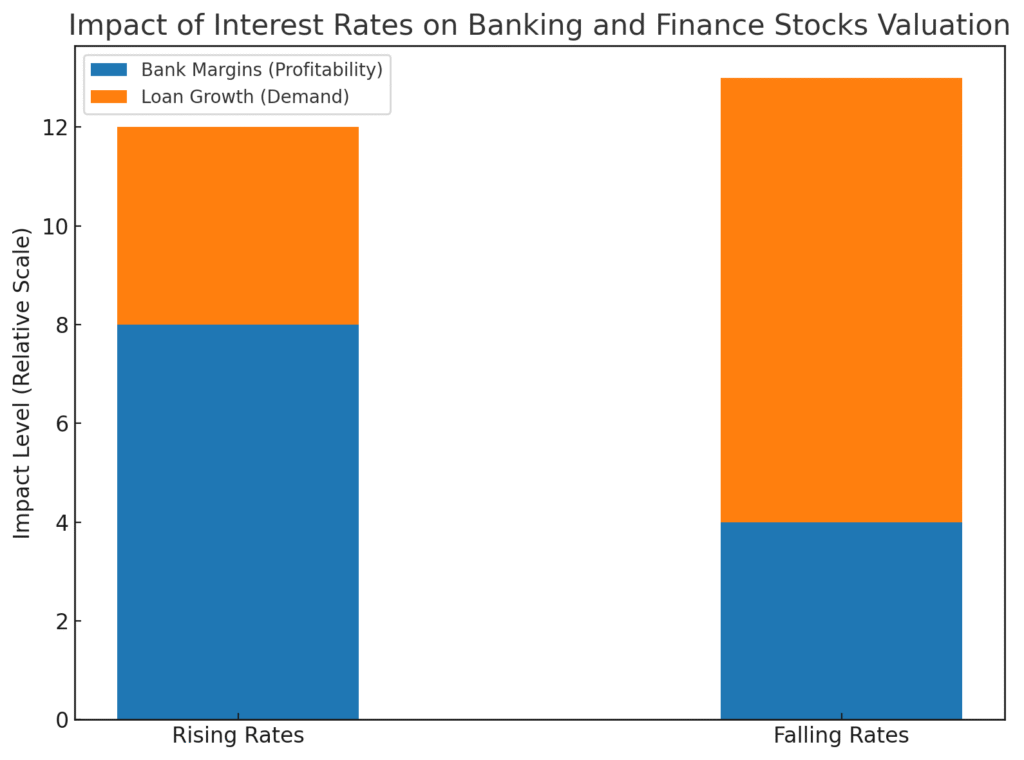

Here’s a quick table to visualize this:

| Interest Rate Trend | Impact on Bank Margins | Impact on Loan Growth | Overall Effect on Valuation |

| Rising Rates | Margins expand (positive short-term) | Loan growth slows (negative long-term) | Mixed – depends on economy |

| Falling Rates | Margins shrink (negative short-term) | Loan growth rises (positive long-term) | Mixed – depends on demand |

So, the stock market’s reaction to rate changes isn’t straightforward. It depends on whether the market focuses on near-term profits or long-term loan growth

Example: Indian Banking Sector

Take 2022–2023 as an example. When the RBI raised repo rates aggressively to combat inflation, banks initially reported higher NIMs, leading to a short-term rally in stock prices of major lenders like HDFC Bank and ICICI Bank. However, by late 2023, concerns about slowing loan growth and rising defaults in unsecured credit segments weighed down valuations

This shows why investors must look at both sides of the coin margins and demand

Regulatory Oversight: The Invisible Hand

Unlike many other sectors, banking and finance is one of the most heavily regulated industries. Regulators like the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), and global equivalents play a constant role in shaping profitability

Key Regulatory Tools That Affect Valuation:

- Capital Adequacy Norms (Basel III in India)

Banks must maintain a minimum capital-to-risk weighted assets ratio (CRAR). Higher requirements mean banks must keep aside more money instead of lending it, reducing short-term profitability but ensuring stability - NPA Recognition and Provisioning

Regulators dictate how and when banks must recognize bad loans (Non-Performing Assets). Stricter norms can hurt profitability in the short run, as more provisioning is required, but they improve transparency and investor confidence in the long run - Lending Restrictions and Priority Sector Lending

In India, banks must allocate a portion of their loans to priority sectors like agriculture or small businesses. While socially important, these sectors often carry lower yields and higher risks, impacting returns - Regulation of NBFCs

Non-Banking Financial Companies (NBFCs) also fall under strict oversight. Any sudden tightening (like the RBI’s post-IL&FS measures in 2018) can dramatically affect their valuations

Case Study: Yes Bank Crisis (2018–2020)

Yes Bank’s collapse is a reminder of how regulatory intervention affects valuations. Initially, Yes Bank grew aggressively by lending to riskier corporates, showing stellar growth numbers. But when bad loans piled up and regulators tightened scrutiny, the bank’s stock price collapsed from ₹400+ levels in 2018 to under ₹20 by 2020.

For investors, this demonstrated that growth without regulatory discipline isn’t sustainable

The Double-Edged Sword of Regulation

- Positive side: Regulations ensure that banks are less likely to collapse suddenly, protecting depositors and maintaining system trust. Investors view a well-regulated environment as safer for long-term returns

- Negative side: Excessive regulation can stifle profitability. For example, mandatory provisioning rules may lead to quarterly earnings volatility, even if long-term fundamentals are intact

This is why valuations often depend on how the market interprets regulatory changes as protective or restrictive

Global Perspective: Lessons from the US

Interest rates and regulations impact banks worldwide. In the United States, rising interest rates in 2022 boosted margins for big banks like JPMorgan and Bank of America. But stricter capital requirements under the Federal Reserve’s stress tests limited how much capital they could return to shareholders via dividends and buybacks

Similarly, the collapse of Silicon Valley Bank (SVB) in 2023 reminded investors that poor interest rate risk management combined with regulatory blind spots can wipe out shareholder value overnight

Valuation Metrics to Watch in Banking & Finance Stocks

To truly understand how interest rates and regulations play into valuation, investors must look at specific metrics:

- Net Interest Margin (NIM) – Shows profitability of lending operations

- Price-to-Book Ratio (P/B) – Crucial for banks, since assets are financial in nature

- Capital Adequacy Ratio (CAR/CRAR) – Measures safety buffer against bad loans

- Gross & Net NPA Ratios – Reflect asset quality

- Return on Assets (ROA) and Return on Equity (ROE) – Indicators of efficiency

Table: Comparing Indian Banks (Hypothetical Example 2025)

| Bank Name | NIM (%) | P/B Ratio | CRAR (%) | Gross NPA (%) | ROE (%) |

| HDFC Bank | 4.1 | 2.8 | 18 | 1.2 | 17 |

| ICICI Bank | 3.9 | 2.4 | 17 | 1.8 | 16 |

| SBI | 3.3 | 1.6 | 14 | 3.0 | 13 |

| Axis Bank | 3.7 | 2.1 | 16 | 2.2 | 15 |

This table highlights how investors compare valuations using both profitability (NIM, ROE) and safety (CRAR, NPA ratios)

Final Thoughts

Banking and finance stocks are not straightforward plays on growth like technology or consumer companies. Their valuations hinge on the delicate balance between interest rate cycles and regulatory frameworks.

- Rising rates may boost margins but hurt loan demand

- Falling rates may encourage lending but squeeze spreads

- Regulations may limit short-term profits but ensure long-term stability

For investors, the key is to track both macroeconomic signals (RBI policy, inflation trends, global interest rate moves) and regulatory updates (capital norms, NPA rules)

The smartest strategy isn’t to chase every bank stock but to pick those institutions that balance profitability with prudence. Banks that manage interest rate risks effectively, maintain high asset quality, and comply smoothly with regulations tend to reward shareholders consistently over the long term

In other words, when investing in banking and finance, it’s not just about numbers on the balance sheet it’s about how these institutions navigate the constantly shifting tides of interest rates and regulations

“While understanding how interest rates and regulations shape the valuation of banking and finance stocks is crucial, investors should also learn how to protect their portfolios with tools like stop-loss orders. You can explore this in detail in our guide on The Role of Stop-Loss Orders in Risk Management.”