This Financial statements beginner guide will teach you from basics about financial statements, key point of financial statement, real life example compare startup company’s with apple, how to find financial statements and 4 things to check when you are going though financial statement

I’ve spent over 20 years in the stock market, and I’ve seen many investors get confused by the technical language companies use. But don’t worry – there’s a straightforward tool that can help you understand a lot about a company: financial statements. These are key to figuring out a company’s financial health and future potential.

Basic of Financial Statements

Think of financial statements like a health check-up for a company. Just like a doctor uses tests to check your health, we use these statements to check a company’s:

- Financial Stability: Can the company pay its bills and stay in business?

- Profitability: Is the company making money and able to grow?

- Growth Potential: Is the company’s revenue and profit increasing over time?

By looking at these statements, we can compare different companies and make smart investment choices.

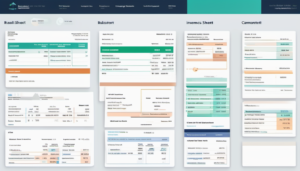

The Three Key Financial Statements

There are three main financial statements you should know about:

- Balance Sheet: This shows what the company owns (assets), what it owes (liabilities), and the value left for shareholders (equity) at a specific point in time. It helps us see if the company can pay its debts and how much is invested by shareholders.

- Income Statement: This shows the company’s performance over a period of time, like a quarter or a year. It details how much money the company made (revenue), how much it spent (expenses), and what’s left over (profit). This tells us how well the company is doing in terms of making money.

- Cash Flow Statement: This tracks the money coming in and going out of the company. It shows how well the company generates cash to run its business and how it spends that cash on investments, paying off debt, and paying dividends to shareholders.

Real-Life Examples

Let’s break it down with a real-life example. Imagine you’re considering investing in two companies: Apple and a new tech startup.

- Apple’s Balance Sheet might show billions in assets, low debt, and high shareholders’ equity, indicating strong financial health.

- The Startup’s Balance Sheet might show high debt and low equity, which could be a red flag for financial stability.

- Apple’s Income Statement would likely show steady revenue growth and strong profitability, proving its successful business operations.

- The Startup’s Income Statement might show growing revenue but no profit yet, indicating it’s still in the early growth phase.

- Apple’s Cash Flow Statement would show strong cash generation from operations, meaning it has plenty of money to invest in new products, pay off debt, and return money to shareholders through dividends.

- The Startup’s Cash Flow Statement might show negative cash flow from operations, meaning it’s burning through cash, which is typical for new companies but something to watch closely.

How to Find and Understand Financial Statements

You can easily find financial statements for most public companies on their websites, usually under the “Investor Relations” section. They’re also available on many financial websites. Don’t worry if you’re not an accountant – there are plenty of resources online and in libraries that explain these statements in simple terms.

4 Important things when you are checking financial statements of company

- Look for Trends: Don’t just look at one year. Check several years of financial statements to see trends in revenue, profit, and cash flow.

- Compare with Competitors: Compare the financial statements of similar companies in the same industry to get a better sense of performance.

- Ratios are Key: Learn basic financial ratios like the current ratio, profit margin, and return on equity. These can provide quick insights into a company’s health.

- Management Discussion: Read the management discussion and analysis (MD&A) section in annual reports. It provides context and management’s perspective on the financial statements.

Unlocking the Secrets

At first, financial statements might seem complicated, but with a little help, they become powerful tools. In our next blog post, we’ll go deeper into how to read and interpret these statements so you can make informed investment decisions. We’ll also show you how to find these statements for any company you’re interested in.

Stay tuned, and let’s embark on this journey to financial literacy together!