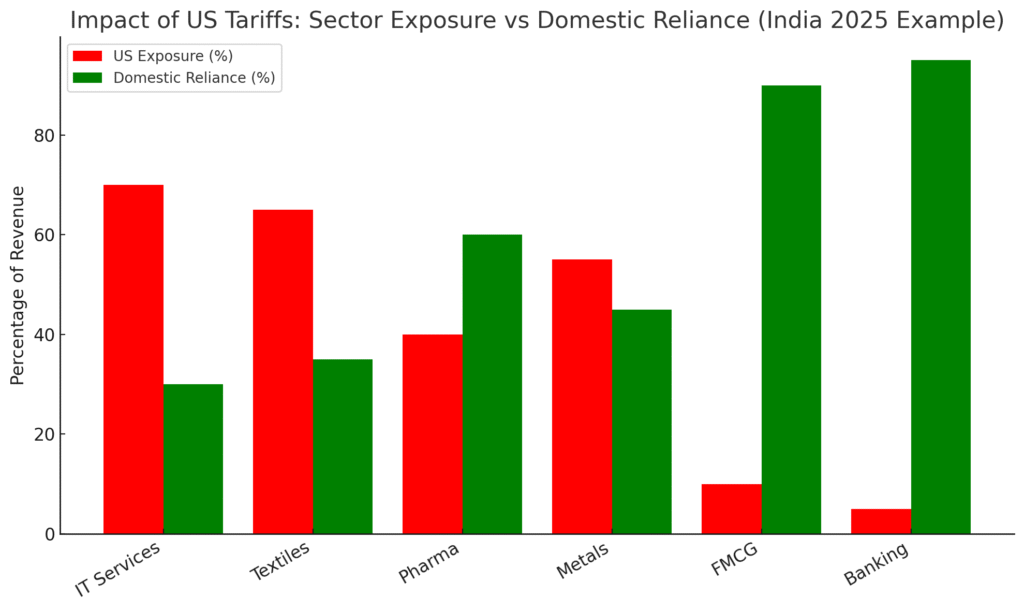

The United States has long been one of India’s most important trading partners, and any change in trade policy between the two countries can create ripples across the market. When tariffs are introduced or increased, they do more than just disrupt trade flows they directly influence Indian stock earnings US tariffs by squeezing profit margins and altering demand patterns. Higher costs for exporters reduce competitiveness in the global market, which in turn affects corporate revenues and ultimately reflects in stock valuations. Sectors such as IT services, textiles, metals, and even pharmaceuticals are particularly vulnerable, as they depend heavily on the US for a significant share of their exports

To make sense of this issue, here are the 10 most common questions traders and investors are asking about the impact of US tariffs on Indian stock earnings

Q1: How do US tariffs directly affect Indian companies?

Tariffs make Indian exports more expensive in the US market. This reduces competitiveness, lowers demand, and cuts into corporate revenues

Q2: Which sectors are most at risk from US tariffs?

IT services, textiles, auto components, and metals are the most exposed because they depend heavily on exports to the US

Q3: Can IT companies like Infosys or TCS be impacted?

Yes. If the US imposes stricter tariffs on outsourcing or services, IT companies face higher costs and potential restrictions, which could slow revenue growth

Q4: What about Indian textile and apparel exporters?

Textiles are highly sensitive. Even a small tariff hike makes Indian goods less competitive compared to cheaper countries like Bangladesh or Vietnam

Q5: How do tariffs affect Indian pharma companies?

Pharma isn’t hit as hard as textiles or IT, but stricter US trade policies can delay approvals or increase compliance costs, affecting margins

Q6: Do tariffs also impact Indian metals and manufacturing?

Absolutely. Higher duties on steel or aluminum exports mean lower international demand, forcing companies to sell at thinner margins domestically

Q7: Will tariffs reduce foreign investment in Indian stocks?

Possibly. If earnings outlook weakens, FIIs (Foreign Institutional Investors) may cut exposure, especially in export-heavy sectors, pressuring stock prices

Q8: Can domestic consumption shield companies from tariff risks?

To some extent, yes. Firms with strong domestic demand (FMCG, retail, banking) are less affected and can offset global weakness

Q9: What should traders watch in earnings reports?

Pay close attention to management commentary on export orders, US market share, and margin guidance. These signals show how tariffs are impacting performance

Q10: How can investors protect themselves from tariff-related volatility?

Diversify portfolios, avoid overexposure to export-driven stocks, and focus on sectors like FMCG, healthcare, or domestic banking that rely more on India’s internal demand

Final Thoughts

US tariffs are more than just trade policy they can shift entire earnings cycles for Indian companies. Export-heavy sectors like IT, textiles, and metals face the highest risk, while domestically driven sectors provide some safety. For investors, the key is balancing exposure: keep an eye on global developments but don’t forget the strength of India’s internal consumption story

In the end, tariffs may pinch Indian earnings in the short term, but strong companies with diversified markets and a focus on innovation will continue to create long-term value

“For a broader view beyond tariff risks, check our outlook on Which Sector Will Perform in the Next Six Months? (2025 Edition).”