Interest rates play a crucial role in shaping the financial landscape, influencing everything from borrowing costs to stock market movements. As an Indian investor, understanding how interest rates—especially those set by the Reserve Bank of India (RBI)—affect your investments can help you make informed decisions. In this blog post, we’ll break down how changes in interest rates impact the stock market, and we’ll provide practical investment strategies to navigate these fluctuations.

What Are Interest Rates and Who Sets Them?

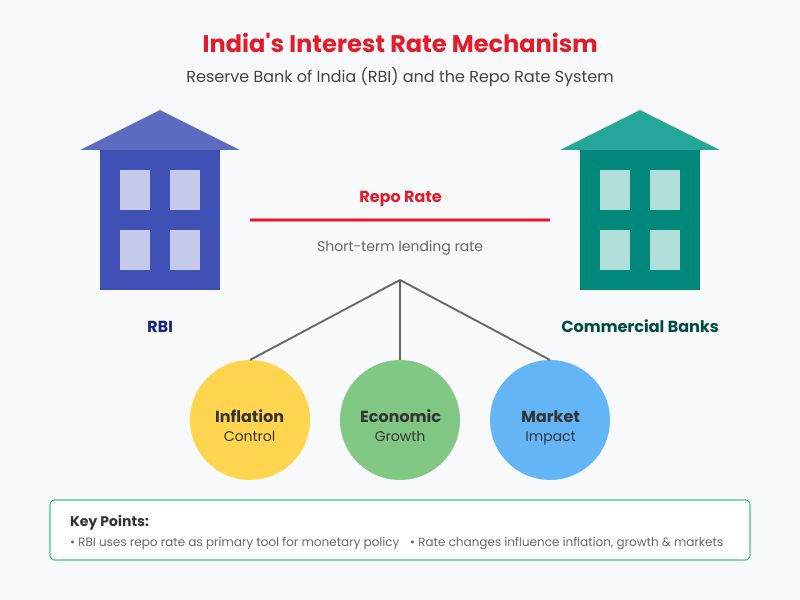

Interest rates are the cost of borrowing money or the return on lending money, expressed as a percentage. In India, the RBI is responsible for setting the country’s benchmark interest rate, called the repo rate. This rate is the rate at which the RBI lends money to commercial banks, and it directly affects the interest rates that banks charge borrowers.

The RBI adjusts this rate based on the economic conditions—raising rates to curb inflation or cutting them to stimulate economic growth. These rate changes send ripples through the economy, including the stock market.

How Interest Rates Influence Stock Market Movements

When interest rates rise or fall, they affect stock markets in several key ways:

- Impact on Corporate Earnings: Higher interest rates increase borrowing costs for companies. Businesses that rely on loans to finance growth (e.g., real estate or infrastructure companies) may see reduced profits due to higher interest expenses. This can negatively impact stock prices. On the flip side, when rates fall, borrowing becomes cheaper, which can lead to more investment and higher corporate earnings, boosting stock prices.

- Investor Sentiment: Rising interest rates can shift investor sentiment. When rates are high, fixed-income investments like bonds become more attractive because they offer higher returns with less risk. As a result, some investors may pull money out of the stock market to invest in bonds, leading to a dip in stock prices. Conversely, when rates fall, stocks often become more attractive, driving prices up as investors seek better returns.

Sector-Specific Impacts of Rising or Falling Interest Rates

Different sectors of the stock market react differently to changes in interest rates. Let’s explore how:

- Banking Sector: Banks tend to benefit from rising interest rates. When rates go up, banks can charge higher interest on loans, increasing their profit margins. Stocks like HDFC Bank and State Bank of India (SBI) often perform well during periods of rising rates.

- Real Estate and Infrastructure: These sectors typically suffer when interest rates rise, as the cost of borrowing increases. Real estate companies like DLF may struggle because higher mortgage rates reduce consumer demand for property.

- Consumer Goods (FMCG): Fast-Moving Consumer Goods (FMCG) companies like Hindustan Unilever may see minimal direct impact from interest rates, but their performance is more closely tied to consumer spending. In times of low interest rates, consumer spending often rises, benefiting FMCG companies.

- IT and Export-Oriented Sectors: The IT sector, represented by companies like Infosys and TCS, may be less sensitive to interest rate changes within India, but they are affected by global economic conditions and exchange rates. When the RBI cuts rates, the rupee might depreciate, which can boost the profits of IT companies as they earn in foreign currencies.

Investment Strategies for Changing Interest Rate Environments

To effectively navigate periods of fluctuating interest rates, you can consider the following investment strategies:

- Sector Rotation: Adjust your portfolio by shifting investments toward sectors that benefit from the current interest rate environment. For example, during periods of rising rates, focus on banking stocks that can profit from higher interest margins. When rates fall, consider sectors like real estate, which thrive on cheaper borrowing costs.

- Focus on Dividend Stocks: In a rising interest rate environment, dividend-paying stocks from stable sectors, like utilities or banking, can provide consistent returns. Look for companies with a strong history of paying dividends, which can offset any potential losses from stock price fluctuations.

- Bonds vs. Stocks: When interest rates are expected to rise, bond prices tend to fall. However, if you expect interest rates to drop, you might consider increasing your bond holdings as bond prices usually rise when rates fall. Diversifying your portfolio with a mix of bonds and stocks can help reduce risk during volatile interest rate cycles.

- Growth vs. Value Investing: Growth stocks tend to be more sensitive to rising interest rates because their future earnings are often discounted at a higher rate, making them less attractive. On the other hand, value stocks, which are more mature and pay regular dividends, may offer better returns in a rising rate environment.

Tools to Monitor Interest Rate Trends

To stay ahead of interest rate changes, it’s important to monitor key indicators from reliable sources. Here are a few tools you can use:

- RBI Website: Keep an eye on announcements regarding repo rate changes and monetary policy updates.

- Financial News Platforms: Websites like Economic Times and Bloomberg provide real-time updates on interest rate changes and their impact on markets.

- Economic Data Reports: Government reports on inflation, GDP growth, and employment can offer clues about the direction of future interest rate changes.

Practical Advice for Investors

- Stay Informed: Regularly monitor RBI policy announcements and broader economic trends to adjust your investment strategy accordingly.

- Diversify Your Portfolio: Include a mix of stocks, bonds, and dividend-paying stocks to weather interest rate fluctuations.

- Review Long-Term Goals: Don’t make hasty decisions based on short-term interest rate changes. Ensure that your investments align with your long-term financial objectives.

Conclusion

Interest rates are a key driver of stock market performance and can significantly influence your investment strategy. By understanding how rising and falling rates affect different sectors and by using tools to track interest rate trends, you can make better-informed decisions to protect or grow your investments.

Whether you’re focusing on dividend stocks, rotating sectors, or balancing between stocks and bonds, having a clear plan in place will help you navigate periods of fluctuating interest rates with confidence.